📐 "First 50 Enterprise Queries Get Custom 3D Warehouse Design" Plan

Executive Summary

Navigating the pallet racking price trends for a first warehouse setup in Southeast Asia is a complex financial and operational crucible. A decision made solely on a bottom-line quote can reverberate through a business for a decade, manifesting as lost throughput, safety incidents, or crippling retrofit costs. In 2025, the pallet racking price trends are shaped not by a single factor, but by a confluence of global material stabilization, intense regional demand, and often-overlooked technical imperatives.

This guide moves beyond simple cost per bay to dissect the anatomy of a reliable storage system investment. It provides a forensic analysis of the factors influencing pallet racking costs, from seismic engineering in Indonesia to humidity resistance in Vietnam, and from steel mill economics to installation tolerances. The objective is to equip procurement managers, warehouse developers, and logistics directors with the framework to make an informed, strategic purchase that ensures scalability, safety, and long-term ROI, effectively turning the understanding of pallet racking price trends from a sourcing challenge into a competitive advantage.

Introduction: The Perilous Allure of the Lowball Quote

The search begins with a seemingly straightforward query: “pallet racking price list Malaysia” or “cost of warehouse shelving Indonesia.” The results present a bewildering spread, a cacophony of numbers where the cheapest option can be 40% lower than the mid-range. The temptation to seize that apparent savings is the first and most costly trap.

Seasoned professionals in the storage solutions industry understand that the upfront hardware cost is merely the visible tip of the iceberg. The true total cost of ownership for warehouse racking lies submerged in engineering precision, compliance integrity, logistical execution, and lifecycle durability. Understanding the current pallet racking price trends, therefore, is less about finding a static number and more about comprehending the value drivers behind it.

This guide serves as a decoder ring for those quotes. It explains why a rack specified for a food storage facility in coastal Thailand must differ—and cost differently—from one in a dry-goods warehouse in inland Myanmar. By dissecting the pallet racking price trends of 2024, businesses can transition from being price-takers to value-driven partners in designing their operational backbone.

The Global and Regional Forces Sculpting 2024’s Price Landscape

A precise forecast of pallet racking price trends requires a dual lens: one focused on global commodity markets, the other on the hyper-local realities of Southeast Asia’s industrial boom.

The Steel Story: Volatility, Quality, and Geographic Arbitrage

Hot-rolled coil (HRC) steel remains the fundamental raw material, its cost constituting the primary raw input for any pallet racking price calculation. While global HRC prices have retreated from their 2022 peaks, 2024 exhibits a “high plateau” effect characterized by stubborn volatility. This ongoing instability is a core factor influencing pallet racking costs. However, the narrative is not uniform.

China’s Role: Benchmark, Supplier, and Competitor. China’s domestic economic policy and construction appetite directly set a baseline for Asian steel prices. For Southeast Asian buyers, Chinese steel is a major, but nuanced, source. The critical distinction lies in grade and specification. The international benchmark for structural racking is grade S355JR (minimum yield strength 355 MPa).

Reputable manufacturers in Thailand or Vietnam using this grade from certified mills present a different price point for pallet racking compared to suppliers offering racks made from milder S235 steel. The latter requires thicker, heavier components to achieve equivalent load ratings, ironically increasing weight-based shipping costs and reducing storage density—a false economy. Thus, a key aspect of analyzing pallet racking price trends is demanding mill certificates, transforming a commodity purchase into a specified material procurement.

ASEAN’s Domestic Ambitions and Realities. Nations like Vietnam and Indonesia are pushing for greater steel self-sufficiency. This can create favorable pallet racking price trends locally but introduces variability in quality consistency. Furthermore, complex tariff structures under agreements like the ASEAN-China Free Trade Area (ACFTA) create a financial maze. A supplier importing finished racking components faces different duties than one manufacturing locally from imported coil. This logistical and fiscal strategy is a significant, often hidden, variable in the final warehouse storage system price quoted to an end-user in Manila or Bangkok.

The Demand Engine: E-commerce, FDI, and Supply Chain Re-alignment

The strategic “China Plus One” shift, coupled with roaring intra-ASEAN trade growth, has ignited a warehouse construction frenzy. From the industrial parks of Johor Bahru to the outskirts of Hanoi, speculative and build-to-suit facilities are rising rapidly. This demand surge fundamentally alters pallet racking price trends from a pure cost-plus model to a capacity-constrained market.

Lead times become a critical, non-monetary cost. A project delay because racks are stuck at port or stuck in a production queue behind larger orders can incur costs far exceeding any per-bay savings from a cut-rate supplier. This market pressure also elevates the importance of supplier reliability and project management capability as intrinsic components of value when evaluating pallet racking price trends.

The Hidden Cost Drivers: The Line Items Missing from the Initial Quote

This is where first-time warehouse developers encounter costly surprises. These elements, rarely detailed in a preliminary bid, dramatically impact the final project outcome and true cost.

Engineering and Design: The Invisible Architecture of Safety

Load Calculation and Layout: The Non-Negotiable Foundation.

Racking cannot be purchased like shelving. Every upright frame, beam, and brace is part of a calculated structural system. A professional, CAD-based layout maximizes pallet positions per square meter while ensuring logical product flow and access. An amateur sketch leads to dead space, inefficient picking paths, and under-utilized clear height. The fee for professional engineering—producing a Static Load Application and Drawings—is an investment that pays for itself instantly in optimized storage density and avoided over-engineering. It is a fixed cost that should be budgeted for upfront, regardless of the underlying pallet racking price trends for materials.

Seismic and Local Code Compliance: A Regional Imperative, Not an Option.

Southeast Asia sits on the Pacific Ring of Fire. Seismic codes in the Philippines (NSCP), Indonesia (SNI), and parts of Thailand and Myanmar are stringent. Racking designed only for vertical static loads will behave catastrophically in a seismic event. Seismic-rated racking requires specific bracing patterns (often X-bracing instead of lighter chord bracing), moment-resistant connections, and frequently, heavier-gauge components. This specification directly and significantly affects the price of selective pallet racking. Ignoring this to adhere to a lower budget based on generic pallet racking price trends is an existential risk to both inventory and personnel. A competent supplier’s first questions will always concern location and seismic zone.

The Quality Spectrum: Where Manufacturing Integrity Dictates Longevity

Pallet racking price trends can obscure a vast range in manufacturing quality, which directly correlates to service life and safety.

Tolerances and Finish: The Details that Matter.

High-quality racking is produced with precision laser cutting and automated welding, ensuring consistency. The protective finish is critical in ASEAN’s humid, often corrosive environments. A proper process involves shot-blasting to create a profile, followed by a multi-stage powder-coating or electrostatic spray for uniform thickness and adhesion. Inferior racks may have uneven weld penetration, misaligned connector holes, and a simple, thin paint layer that will chip and rust, compromising structural integrity within years. The cost differential here is a direct payment for longevity, a crucial consideration when analyzing long-term pallet racking price trends.

Component-Level Scrutiny.

Upright Frames: The column profile’s design and steel thickness, the gauge of the horizontal and diagonal braces, and the robustness of the base plate are paramount. A thin, flexible base plate can bend during anchor bolt tightening, creating an unstable foundation.

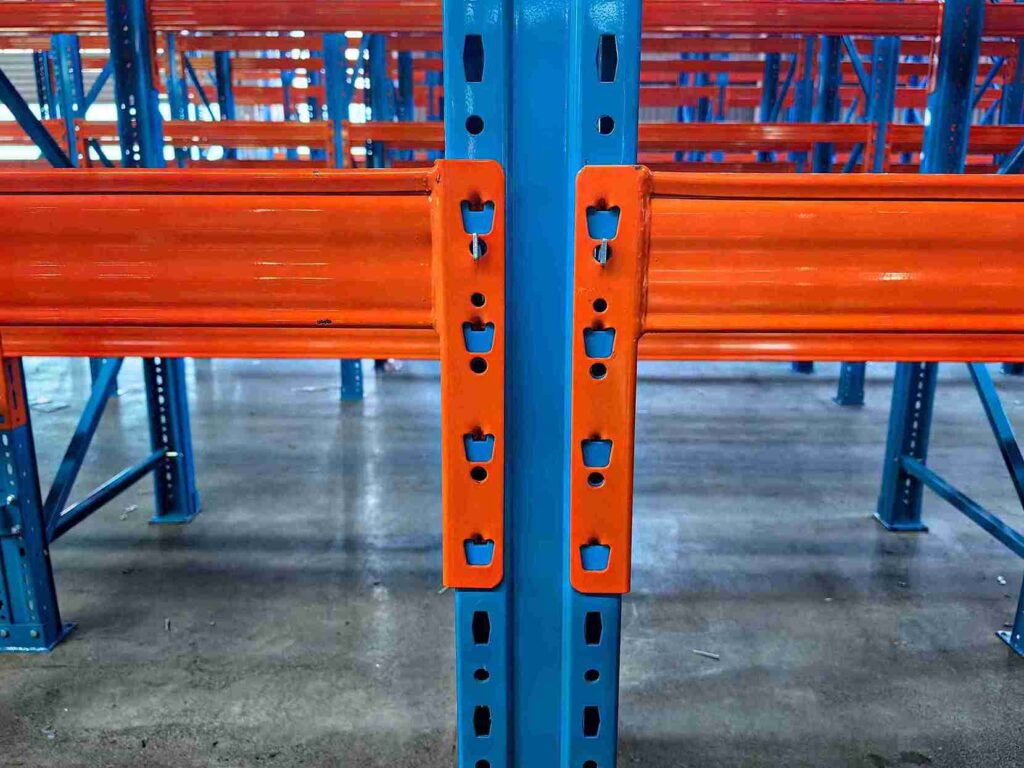

Beams: The beam-end connector is a critical failure point. Low-cost beams use simple stamped tabs that can deform or dislodge. High-quality systems employ welded end-plates with forged hooks or bolted connections, complemented by positive safety locks. The price per beam reflects this engineering.

Accessories: Wire mesh decking, column guards, and pallet supports are frequently afterthoughts but are essential for safety and functionality. Their quality and load capacity must be specified and verified.

Logistics, Installation, and The “On-Site Surprise” Factor

The Complex Journey to Site.

The logistics chain from factory to foundation is fraught with cost variables. A container shipment from Qingdao to Surabaya faces port congestion, customs brokerage complexities, and last-mile delivery challenges. The chosen Incoterms (e.g., EXW, FOB, CIF, DAP) dramatically alter risk and cost responsibility for the buyer. A low pallet racking price on an EXW basis can be obliterated by unexpected freight costs, demurrage fees, and import duty miscalculations. Suppliers with established in-country logistics partners or local assembly offer a significant advantage in managing these variables, providing more predictable final costs despite fluctuating global pallet racking price trends.

Professional Installation:

The Final, Critical Link. Installation is a skilled trade requiring torque wrenches, laser levels, and strict procedural adherence. Unlevel frames or improperly torqued anchors create latent points of failure. Professional installers provide method statements, conduct anchor pull-out tests, and deliver a commissioning report. This service cost is a direct investment in safety, warranty validity, and system performance. Opting for untrained labor to save money negates the engineering invested in the system and is a severe false economy, a stark lesson often learned too late by those who focus only on the upfront pallet racking price.

A Strategic Procurement Framework: Navigating the Quotes

Armed with an understanding of the forces behind pallet racking price trends, buyers can implement a structured procurement process.

Phase 1: Internal Discovery – Building the Specification from Within

Inventory Profiling: Document all unit load types: wood vs. plastic pallet dimensions, exact pallet condition, and most importantly, maximum gross weights. Planning for averages guarantees future overloads.

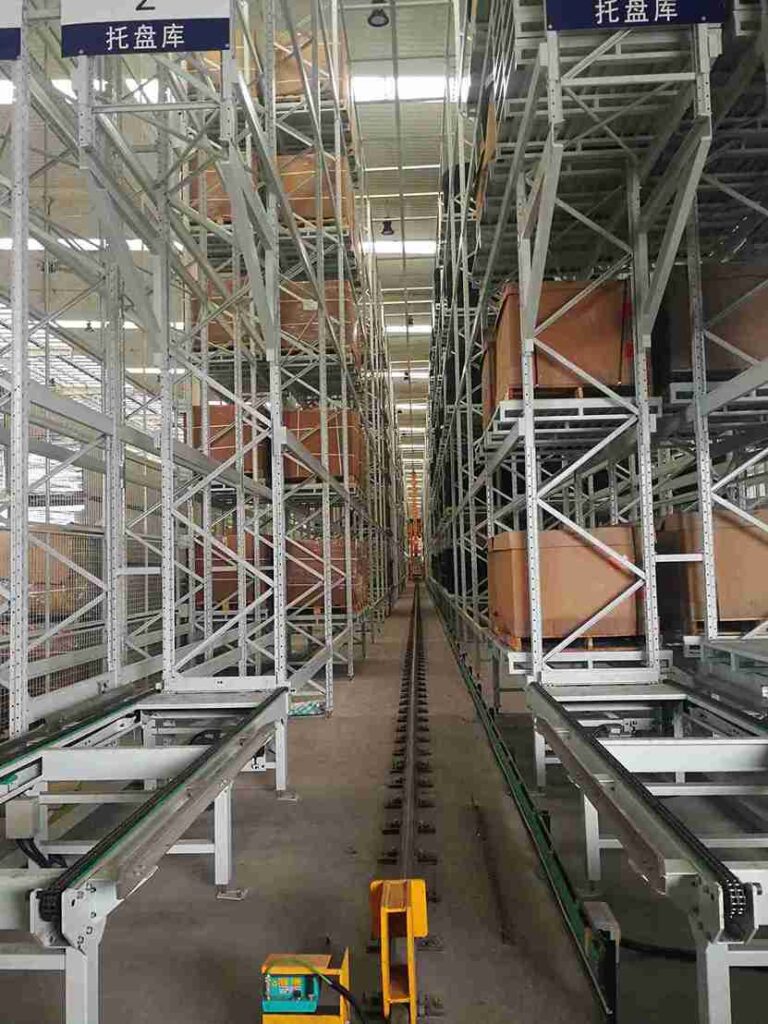

Operational Mapping: Chart the physical flow of goods from receiving to dispatch. This determines required aisle widths (for reach trucks vs. counterbalance forklifts), picking methodologies, and influences the choice between selective racking and high-density systems like drive-in or pallet shuttle racking, each with distinct price trends.

Metric Definition: Establish clear targets: total pallet positions, SKU count, desired throughput per shift. Include a 3-5 year growth projection to assess system scalability.

Site Data Assembly: Provide potential bidders with a building layout showing column locations, a floor flatness report, ceiling height clearances, and details on fire suppression systems and lighting. Inaccurate site data is a primary source of post-order cost adders.

Phase 2: Supplier Vetting – Evaluating Capability Beyond Price

A rigorous evaluation checklist must precede any request for quotation:

Regional Experience: Request case studies of similar-scale projects in your specific country and industry (e.g., cold storage in Thailand, automotive parts in Vietnam).

In-House Engineering Capability: Do they employ licensed structural engineers who can stamp calculations for local permit approval? This is a major differentiator.

Manufacturing and Quality Assurance: Where is production done? Can you audit the facility? What certifications are held (ISO 9001, FEM 10.2.02, RMI MH16.1)? Demand to see material test certificates.

Service Scope: Do they offer a true turnkey solution: design, supply, installation, and inspection? Is after-sales support and periodic inspection available?

Phase 3: The Apple-to-Apple Quote Comparison

A meaningful comparison matrix must enforce direct equivalency. Each quote should be broken down to include:

Technical Schedule: Steel grade, column thickness (e.g., 2.0mm, 2.5mm), beam type (step, box, structural), finish specification (e.g., 80-micron polyester powder coat), safety lock type.

Detailed Pricing: Itemized cost for upright frames, beams, braces, decking, column guards. Separate line items for engineering drawings, delivery (with clear Incoterms), installation labor, and project management.

Deliverables: A detailed layout drawing, General Arrangement (GA) drawings, and the formal Load Application Drawings.

Commercial Terms: Payment schedule, warranty duration and coverage, lead time guarantees, and liability clauses.

Future-Proofing: The Automation Readiness Premium

The overarching trend in warehouse automation makes future-proofing a critical cost-avoidance strategy. Designing for potential automation from day one protects the capital investment.

Designing for an Automated Future

This involves specifying features that may have a minor upfront cost impact but prevent a total system replacement later:

Enhanced Tolerances: Automated systems like AS/RS or pallet shuttles require near-perfect upright verticality and beam level alignment. Tighter tolerances must be specified during manufacturing and verified during installation.

Standardized Geometry: Adopting bay widths and heights compatible with common automation equipment brands provides future flexibility.

Increased Dynamic Load Capacity: Anticipating the added forces from moving shuttles or robots may require upsizing beams or uprights initially.

Discussing this strategic intent with suppliers is essential. A forward-thinking partner will advise on the modest premium for an “automation-ready” design, a smart investment against the backdrop of long-term pallet racking price trends and technological evolution.

Conclusion: Price is a Transaction, Value is an Investment

The deep dive into the multifaceted world of pallet racking price trends for 2024 confirms a fundamental truth: the lowest initial price is frequently the most expensive long-term path. The Southeast Asian market is maturing, rewarding strategic buyers who prioritize engineering rigor, quality assurance, and total project partnership. A warehouse racking system is not a commodity; it is the foundational skeleton of the supply chain. Its strength, precision, and adaptability determine operational ceiling.

By adopting a disciplined framework—conducting thorough internal discovery, vetting suppliers on technical merit and local expertise, comparing quotes on a truly equivalent basis, and embedding future-readiness into the design—businesses elevate their procurement from a tactical purchase to a strategic investment. They are buying not just metal, but predictable throughput, inherent safety, and scalable growth potential. Mastering the true drivers behind pallet racking price trends is the key to avoiding costly mistakes and securing a warehouse infrastructure that becomes a durable competitive asset.

Frequently Asked Questions (FAQs)

1. How do fluctuating currency exchange rates impact the pallet racking price trends we see in our local market?

Currency volatility, particularly between the US Dollar (the currency of steel trade) and local currencies like the Indonesian Rupiah (IDR) or Thai Baht (THB), is a direct and immediate factor influencing pallet racking costs. A supplier who imports materials or finished goods will typically quote based on a USD reference price.

A weakening local currency between the quote date and the payment date for materials can erode supplier margins, potentially leading to requests for price adjustments or, in fixed-price contracts, squeezing the supplier’s ability to use quality materials. This risk is often baked into contingency pricing. When analyzing pallet racking price trends, it’s prudent to inquire about the supplier’s hedging strategy or consider working with locally manufacturing firms with more stable cost bases in the local currency.

2. For a mixed SKU warehouse with varying pallet sizes, is adjustable beam-level racking significantly more expensive, and how does it affect the total cost of ownership?

Adjustable beam-level (selective) racking is the standard for flexibility. The cost premium for highly adjustable systems (with multiple beam locking positions every 25-50mm) versus a system with fixed beam levels is generally marginal in the context of the total project—often 2-5%. However, its impact on the total cost of ownership is profoundly positive. It allows for seamless adaptation to changing inventory profiles, maximizes vertical space utilization for different SKU heights, and facilitates easy reconfiguration during seasonal shifts. This flexibility avoids the massive future cost of buying entirely new racking or suffering from wasted space. Therefore, when evaluating pallet racking price trends, the value of adaptability often outweighs a minor upfront premium.

3. What are the real cost implications of choosing a “copy” or locally fabricated racking system versus a branded, internationally certified one?

The cost difference can be substantial, sometimes 30-50% lower for the “copy” system. However, the implications are severe. Non-certified, copycat racking often lacks proper engineering documentation (Load Application Drawings), uses unverified material grades, and has unknown safety factors. This makes it illegal for use in many jurisdictions with strict workplace safety regulations and voids insurance in case of an accident. The real cost implications include: total loss of investment if shut down by authorities, catastrophic liability in a collapse, and inability to integrate with any future automation. The pallet racking price trends for certified versus non-certified products represent the cost of legal compliance, insurability, and fundamental risk mitigation.

4. How does the choice of forklift type (e.g., Reach Truck vs. Counterbalance) influence the racking design and associated warehouse storage system price?

The forklift type is a primary design driver. Reach trucks operate in narrower aisles (typically 2.7-3.2 meters), which increases storage density but requires the racking to be designed for higher precision and potentially higher lateral forces from mast movement. This can necessitate slightly more robust uprights. Counterbalance forklifts require wider aisles (3.5-4.5 meters), reducing density but often allowing for slightly lighter racking specs in low-bay applications.

The warehouse storage system price is affected not just by the racking itself, but by this holistic design choice: narrower aisles with reach trucks mean more pallet positions per square meter (higher racking cost per area but lower cost per pallet position) and a higher upfront cost for the specialized forklift. A total project cost analysis must include both MHE (Material Handling Equipment) and racking.

5. Can we phase our racking purchase to align with budget cycles, and how does this strategy interact with pallet racking price trends?

Phasing is possible but requires master planning. A professional supplier can create a master layout for the full final build-out. The initial purchase would be for Phase 1, with future phases designed to integrate seamlessly. The risk is that pallet racking price trends may shift. Steel prices could rise, or the supplier’s specific component profiles could be discontinued.

To mitigate this, it is advisable to: 1) Purchase spare connectors and safety locks initially, 2) Secure a formal quotation for future phases with a defined price validity period and escalation clause, and 3) Ensure the master layout is documented and retained. Phasing is a cash-flow management tool, but it introduces future cost uncertainty against the backdrop of inevitable pallet racking price trends movement.

If you require perfect CAD drawings and quotes for warehouse racking, please contact us. We can provide you with free warehouse racking planning and design services and quotes. Our email address is: jili@geelyracks.com