📐 "First 50 Enterprise Queries Get Custom 3D Warehouse Design" Plan

Maximizing Warehouse Space & Efficiency: The Authoritative Guide to Leased Narrow Aisle Solutions

For logistics directors, warehouse managers, and business owners navigating the rapid growth markets of Southeast Asia, the Middle East, Africa, and Latin America, the physical constraints of a warehouse often become the single greatest bottleneck to scalability. The solution, however, is not always a costly expansion. The paradigm shift towards high-density storage, specifically through leasing narrow aisle equipment, represents a strategic and financial masterstroke.

This comprehensive guide delves beyond superficial overviews to provide a granular, actionable blueprint. It explores how a commitment to leasing narrow aisle equipment transforms capital expenditure into a scalable operational cost, facilitates access to cutting-edge technology, and builds a direct bridge to full automation. Herein lies the detailed roadmap for evaluating, implementing, and optimizing a leased narrow aisle equipment solution to achieve unparalleled storage density and operational throughput, all while preserving vital capital for core business growth.

The Unavoidable Calculus of Modern Warehousing

Across emerging economies, the surge in consumer demand, manufacturing output, and e-commerce penetration is colliding with fixed warehouse footprints. The vertical cube of a facility—often underutilized—is the final frontier for efficiency gains. Traditional wide-aisle layouts, serviced by counterbalance forklifts, are relics of a less space-sensitive era. They represent not just inefficient space use, but also slower cycle times, increased product damage risk, and higher energy consumption per pallet moved. The transition to narrow aisle (NA) and very narrow aisle (VNA) configurations is not a mere improvement; it is a competitive necessity.

However, the capital required for a comprehensive narrow aisle equipment acquisition—including specialized trucks, guidance systems, and reinforced racking—can be prohibitive. This financial barrier makes the model of leasing narrow aisle equipment not just an option, but frequently the most intelligent entry point into high-density warehousing. The act of leasing narrow aisle equipment demystifies the technology and democratizes its benefits for growth-focused companies.

The Strategic Rationale for Leasing Over Buying

The decision between purchasing and leasing narrow aisle equipment hinges on a broader view of asset management and strategic agility. Purchasing locks a company into a specific technology for its entire depreciation cycle, often 7-10 years. In a sector where automation and software integration are advancing rapidly, this poses a significant obsolescence risk. Conversely, leasing narrow aisle equipment is inherently future-proof. It redefines the asset from a owned piece of machinery to a purchased outcome: predictable, high-density storage and retrieval performance.

Financially, leasing narrow aisle equipment converts a large, upfront capital expenditure (CAPEX) into a predictable, periodic operational expense (OPEX). This conservation of capital is critical in dynamic markets where liquidity is paramount for seizing new opportunities. From a balance sheet perspective, operating leases (depending on local accounting standards, such as IFRS 16) can offer favorable treatment, keeping significant debt off the books and maintaining healthier financial ratios for borrowing. Tax implications also differ; payments for leasing narrow aisle equipment can often be fully deducted as a business expense, providing a consistent yearly benefit rather than a multi-year depreciation schedule.

Operationally, a full-service agreement for leasing narrow aisle equipment typically bundles maintenance, software updates, and even performance guarantees. This transfer of risk—from equipment downtime and repair costs to the lessor—is a monumental shift. It allows warehouse managers to focus purely on throughput and accuracy, not on maintaining a fleet. The provider’s incentive aligns with the client’s: to maximize uptime and productivity of the leased narrow aisle equipment.

Deconstructing the Components: What Does a Lease Package Actually Include?

A robust program for leasing narrow aisle equipment is far more than a truck rental. It is an integrated materials handling ecosystem. Understanding each component is key to appreciating the value.

H3: The Equipment Core: NA and VNA Forklifts

The centerpiece is the forklift itself. Leasing narrow aisle equipment commonly involves two classes:Narrow Aisle Reach Trucks: For aisles as narrow as 2.4-2.7 meters. These are versatile, often pedestrian-controlled or with a small cab, and represent a significant first step in density improvement.

Very Narrow Aisle (VNA) Turret or Swing-Mast Trucks: For aisles from 1.6 to 2.0 meters. These are high-performance machines. Operators work in a “man-up” configuration, traveling with the load to heights exceeding 15 meters. Leasing narrow aisle equipment of this caliber almost invariably includes a guidance system—either inductive wire embedded in the floor or optical guides—which eliminates operator steering drift, enables faster travel speeds, and is essential for safety at height.

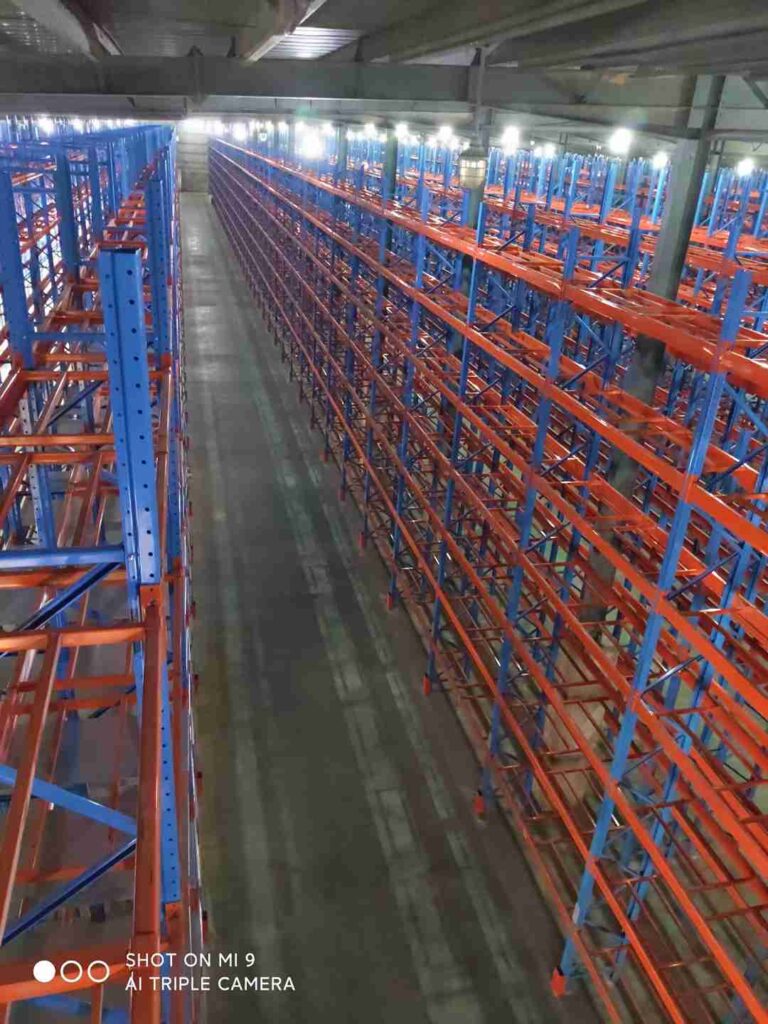

H3: The Structural Backbone: High-Density Storage Racking

You cannot separate the equipment from the storage medium. Therefore, a comprehensive solution for leasing narrow aisle equipment includes the racking system engineered to work in concert with the trucks. This can involve:Selective Pallet Racking (VNA-Grade): Built with tighter tolerances and higher load capacities for greater heights.

Double-Deep Racking: Utilizing the VNA truck’s deep-reach capability to store two pallets deep, nearly doubling density without sacrificing selectivity.

Drive-In Racking (for VNA applications): A high-density option for homogeneous products, where the VNA truck drives directly into the rack structure.

Pallet Shuttle Compatible Systems: The racking is designed to integrate battery-powered shuttles, creating a semi-automated buffer within the lane, a perfect example of how leasing narrow aisle equipment can include hybrid automation.

H3: The Digital Layer: Software and Integration

Modern narrow aisle equipment is a data-generating asset. A lease package should address the control layer. This includes:Onboard Fleet Management Telematics: Monitoring usage, impacts, battery status, and pre-failure diagnostics.

Interface with Warehouse Management Systems (WMS): Ensuring the equipment can receive pick/put instructions directly from the WMS via an RF or touchscreen terminal, maximizing accuracy and speed.

Warehouse Navigation Software (for AGV-ready systems): In advanced setups, the infrastructure installed for leasing narrow aisle equipment today (like precise rack alignment and floor guides) can be the same used for automated guided vehicles tomorrow.

The Implementation Lifecycle: From Assessment to Optimization

Success with leasing narrow aisle equipment hinges on a meticulous, phased approach.

Phase 1: Holistic Feasibility and Digital Simulation

This critical first step moves beyond guesswork. Specialists in leasing narrow aisle equipment will conduct a multi-faceted site audit:

Product Profile Analysis: Examining SKU dimensions, weight, turnover (ABC classification), and special handling needs.

Facility Audit: Measuring clear heights, column positions, floor flatness and load-bearing capacity, door locations, and electrical infrastructure.

Throughput Modeling: Analyzing inbound, outbound, and internal movement volumes to determine the optimal number and type of machines.

3D Simulation & Digital Twin Creation: This is the cornerstone of a professional proposal. Using software like CAD or specialized simulation tools, consultants build a virtual model of the proposed warehouse. They test different scenarios of leasing narrow aisle equipment and racking configurations, visually demonstrating the exact space savings, potential throughput gains, and traffic flow before any financial commitment is made. This de-risks the entire project.

Phase 2: Tailored Financial and Technical Structuring

Based on the simulation data, a formal proposal for leasing narrow aisle equipment is crafted. This document should be exceptionally detailed, specifying:

Equipment Make/Model/Specifications: Including lift capacity, lift height, power type (e.g., lithium-ion), and all required attachments.

Complete Racking Bill of Materials: Itemizing every beam, upright, footplate, and safety component.

Guidance System Specifications: Type, layout, and installation method.

Full-Service Lease Terms: Clearly outlining the monthly payment, lease term (e.g., 5 years), included maintenance scope, parts coverage, response time SLA (e.g., 4-hour onsite for critical faults), and operator training provisions.

End-of-Lease Options: Defining the process for renewal, upgrade, or purchase at fair market value.

Phase 3: Managed Installation and Competency Transfer

A professional provider treats the installation as a turnkey project.

Phased Roll-out Planning: The new leased narrow aisle equipment and racking are installed in sequenced zones to minimize operational disruption.

Certified Installation: Employing trained engineers and riggers to ensure the racking is perfectly plumb, level, and anchored, which is non-negotiable for VNA safety.

Comprehensive Training: Conducting rigorous, certified training for operators and maintenance staff. This covers not only basic operation but also advanced maneuvering, safety protocols in ultra-narrow aisles, battery management, and daily checklists.

Phase 4: Continuous Partnership and Performance Analytics

The relationship after installation defines the true value of leasing narrow aisle equipment. A superior provider acts as a performance partner:

Telematics-Driven Insights: Providing the client with a dashboard showing fleet utilization, idle time, travel distances, and energy consumption. This data is used for continuous improvement.

Scheduled Performance Reviews: Holding quarterly or biannual meetings to review KPIs against projections, discuss challenges, and plan for seasonal peaks.

Technology Refresh Planning: As the lease term nears its end, initiating discussions about the next generation of technology, ensuring the client’s operation never falls behind.

Financial Modeling: A Detailed Comparative Analysis

Consider a practical scenario for a distribution center in Indonesia or Saudi Arabia needing to increase capacity by 3,000 pallet positions.

The Outright Purchase Scenario:

Initial Outlay: $450,000 (2 x VNA trucks, guidance system, racking for 3,000 locations, installation).

Year 1-5 Annual Costs: ~$15,000/year for maintenance contracts, rising to ~$25,000/year as equipment ages. Unplanned repair costs: variable and unpredictable.

Technology Status in Year 5: Equipment is 5 years old, potentially lacking latest software/safety features. Resale value is depreciated.

Cash Flow Impact: Large negative shock in Year 1, constraining other investments.

The Leasing Narrow Aisle Equipment Scenario:

Initial Outlay: Minimal. Possibly a first month’s payment and a security deposit.

Year 1-5 Annual Costs: A fixed monthly payment of, for example, $6,500 (totaling ~$78,000/year). This payment includes all planned maintenance, parts (excluding wear items like tires), software updates, and service support under an SLA.

Technology Status in Year 5: At lease end, options include upgrading to newer, more efficient models of narrow aisle equipment, extending the lease at a reduced rate, or purchasing the existing fleet at its then fair market value.

Cash Flow Impact: Smooth, predictable OPEX. Capital of $450,000 remains available for inventory, marketing, or business development.

The model for leasing narrow aisle equipment provides predictability, risk mitigation, and strategic flexibility that outright purchase cannot match.

Synergizing with the Automation Roadmap

A strategically executed plan for leasing narrow aisle equipment is the most pragmatic first step toward a fully automated warehouse. The high-density racking structure installed is the foundational “grid” for future robots. The data collected on product movement patterns from the leased narrow aisle equipment telematics informs the logic for future automation. Companies often follow this path:

Phase 1: Leasing narrow aisle equipment (VNA) to achieve maximum density and establish perfect inventory positioning.

Phase 2: Integrating an automated conveyor or sortation system for case picking, fed by the VNA aisles.

Phase 3: Replacing some of the leased narrow aisle equipment with automated guided vehicles (AGVs) or autonomous mobile robots (AMRs) for horizontal transport, or even adopting a fully automated storage and retrieval system (AS/RS) for the very fastest-moving goods.

Because the client was leasing narrow aisle equipment, the transition from Phase 1 to Phase 3 is financially and operationally fluid, not a second monumental capital project.

Regional Application Notes: Tailoring the Solution

The value proposition of leasing narrow aisle equipment resonates powerfully across target regions, but with nuanced emphases:

Southeast Asia (Vietnam, Thailand, Indonesia): For booming e-commerce and manufacturing, leasing narrow aisle equipment offers the speed of deployment and scalability to match erratic growth curves, without massive upfront investment that strains start-up or SMB finances.

Middle East (UAE, Saudi Arabia): In markets focused on becoming global logistics hubs, leasing narrow aisle equipment allows for the adoption of world-class, high-tech infrastructure with predictable costs, appealing to multinational 3PLs and large distributors who prioritize system reliability and uptime guarantees.

Africa (Nigeria, Kenya, South Africa): Where financing can be challenging, leasing narrow aisle equipment provides access to modern technology that would otherwise be out of reach, enabling local businesses to leapfrog legacy systems and build efficient, modern supply chains.

Latin America (Mexico, Brazil, Colombia): For industries like automotive and agriculture, facing fluctuating commodity prices, the OPEX model of leasing narrow aisle equipment provides a hedge against market volatility, aligning storage costs more closely with revenue.

Conclusion: The Strategic Imperative of Leasing

In conclusion, the journey to maximize warehouse space and efficiency is fundamentally a journey about smart capital allocation and risk management. For logistics leaders in high-growth markets, the equation is clear. The outright purchase of narrow aisle equipment represents a substantial, rigid investment in a specific technological moment. In contrast, the strategic decision of leasing narrow aisle equipment represents an investment in long-term agility, operational excellence, and financial resilience.

It is a partnership that delivers not just equipment, but guaranteed performance, continuous innovation, and a clear pathway to the automated future. The question for forward-thinking businesses is no longer whether to adopt high-density storage, but how to do so with the least risk and greatest strategic advantage. The evidence overwhelmingly points to a well-structured program for leasing narrow aisle equipment as the definitive answer.

(FAQ Section)

1. How does the process for leasing narrow aisle equipment handle existing racking that we own?

A professional assessment is crucial. If existing racking is structurally sound and meets the precise specifications required for the new leased narrow aisle equipment (e.g., beam height tolerances, upright alignment), it may be integrated. However, even a few millimeters of misalignment can be hazardous in a VNA environment. Often, the solution for leasing narrow aisle equipment includes new, precision-engineered racking to ensure total system integrity and safety. The lease can be structured to include the removal of old racking and installation of the new system.

2. Can we include ancillary equipment like floor scrubbers or personnel lifts in the same lease as our narrow aisle equipment?

Yes, this is a common and efficient practice known as a “bundled lease” or “facility lease.” Providers specializing in leasing narrow aisle equipment often have partnerships to include other essential warehouse assets. This simplifies procurement, creates a single monthly payment for multiple equipment types, and can often result in more favorable overall terms due to the larger aggregate value.

3. What are the typical insurance requirements when leasing narrow aisle equipment?

The lessor (the leasing company) typically retains ownership and thus insures the equipment against total loss (e.g., fire, catastrophic damage). The lessee (the client) is almost always required to carry a liability insurance policy that names the lessor as an additional insured and covers potential damage to the equipment from collisions or improper use, as well as third-party liability. Specific requirements are detailed in the lease agreement. Providers of leasing narrow aisle equipment can usually recommend insurance partners familiar with these requirements.

4. How does the transition work at the end of the lease term if we choose to upgrade?

A reputable provider plans this transition 6-12 months before lease expiry. The process for transitioning leased narrow aisle equipment involves a joint review of the client’s evolving needs, a demonstration of new technology options, and the structuring of a new lease agreement. The swap-out is then meticulously planned—often aligning with a slower business period—to remove the old leased narrow aisle equipment and install the new system with minimal downtime. Data migration from old telematics to new systems is also managed.

5. Are there any hidden costs we should watch for in a lease agreement for narrow aisle equipment?

Transparency is key. Scrutinize the “Exclusions” section of the maintenance agreement. Potential extra costs can include: wear items (fork tips, tires, batteries if not covered), damage repairs from operator abuse, costs associated with consumables like guidance wire paste, and fees for training additional operators beyond an agreed number. A superior proposal for leasing narrow aisle equipment will clearly list all inclusions and exclusions upfront, ensuring total cost predictability.

If you require perfect CAD drawings and quotes for warehouse racking, please contact us. We can provide you with free warehouse racking planning and design services and quotes. Our email address is: jili@geelyracks.com